In a big way the pandemic has throttled the demand from foreign real estate investors to buy American homes. Saint Johnsbury VT 05819 Today.

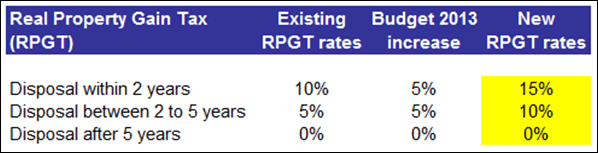

Budget 2013 Real Property Gain Tax Rpgt Increased To 15

Axis REIT 2Q net property income up 1834 declares 255 sen DPU.

. Most countries laws on REITs entitle a. However you can get a waiver for RPGT once in a lifetime. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax.

Real Time Tax and Customs Payments. The Malaysian government has constantly been introducing tax incentives to promote REITs in the capital market. Axis REIT net income jumps to RM429mil in 2Q.

Assessment Of Real Property Gain Tax. Before the pandemic hit 2020 was shaping up to be. Property tax is imposed at 1-2 but the base differs depending on use.

This includes the following. The principal objective of the joint venture was to increase the local assembly and manufacturing activities of Mazda in Malaysia. For commercial and industrial properties the tax base is 50 of the propertys market value.

The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues. Imposition Of Penalties And Increases Of Tax. The capital gains tax property 6-year rule allows you to use your property investment as if it was your principal place of residence for a period of up to six years whilst you rent it out.

Chinas real estate market has grown greatly in the past years and is a key component in the Chinese economy. Income from property. A real property gains tax RPGT has been introduced in 2010.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. Weve seen both ups and downs with a big correction in 2015-2016 during the stock-market crash. In the event an SPV is formed as a company under the Companies Act 2016 the shareholders of the SPV will execute a joint venture agreement and a shareholders agreement.

Case Report Stay of Proceeding. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate. One huge tax benefit of a REIT is that most income earned by it is exempted from income tax.

A dividend interest royalty rent natural resource amount or other amount arising from the provision use or exploitation of property. Winds light and variable. This means that you would be able to sell the property within the six-year period and be exempt from paying capital gains tax just as you would if you.

Paragraph 34A of Schedule 2 of the Real Property Gains Tax Act 1976. Government of Malaysia V MNMN. Company with paid up capital not more than RM25 million.

The net gain from the disposal of an asset that was acquired for the purpose of. The tax is 5 final tax or 25 from 8 September 2016 on the taxable sale value or the actual proceeds whichever is higher. 20 Mar 2016 0957 AM Post 4.

Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. The local government code provides for the maximum tax rates that local governments may impose on business activities in their jurisdiction. Although COVID has been bad for many of us in so many ways the pandemic did one good thing.

TRANSFER OF PROPERTY BY LOVE AND AFFECTION MALAYSIA. Exempt Income Regulations 2016. TRANSFER OF PROPERTY MALAYSIA.

Currently Chinas economy has slowed down and we see an escalating trade war with the US. And when it comes to Real Property Gain Tax RPGT if there is any gain from the transaction your husband might need to pay it. Destiny in trading stock high or low selling price is merely psychological.

2016 UPDATES ON STAMP DUTY MALAYSIA FOR YEAR 2022. Paragraph 11 2c Schedule 2 of Real Property Gains Tax Act 1967. Get FREE real time quotes on our website App.

Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. The pandemic helped protect American homebuyers from a resurgence in foreign real estate investors. In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses.

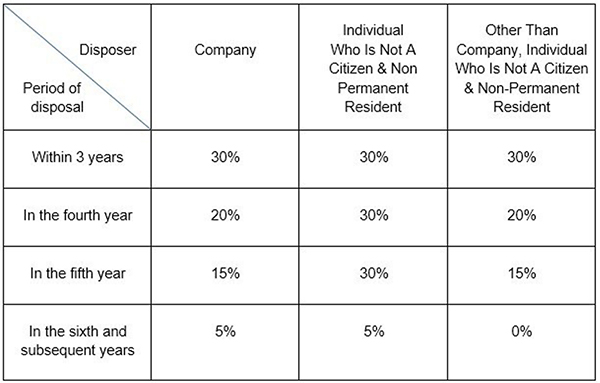

Real Property Gain Tax.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

What Is Real Property Gains Tax The Malaysian Bar

New York State Enacts Tax Increases In Budget Grant Thornton

Zerin Properties Real Property Gains Tax

Taxation On Property Gain 2021 In Malaysia

Budget 2015 Self Assessment For Real Property Gains Tax Rgpt Tax Updates Budget Business News

Real Property Gains Tax Part 1 Acca Global

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Real Property Gains Tax Part 1 Acca Global

Budget 2015 Self Assessment For Real Property Gains Tax Rgpt Tax Updates Budget Business News

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

The Overwhelming Case Against Capital Gains Taxation

Real Property Gains Tax After Death Rockwills Info

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

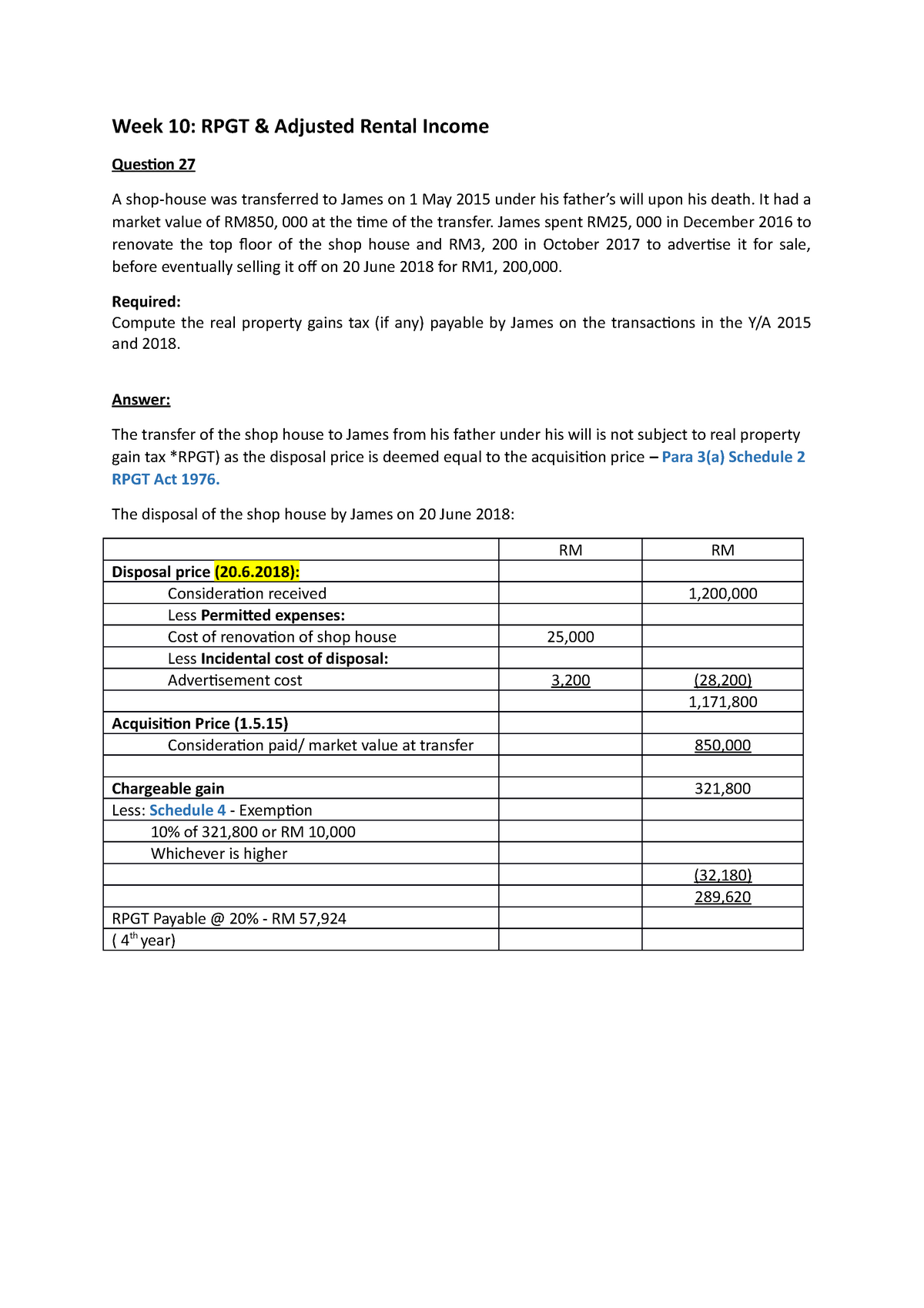

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu